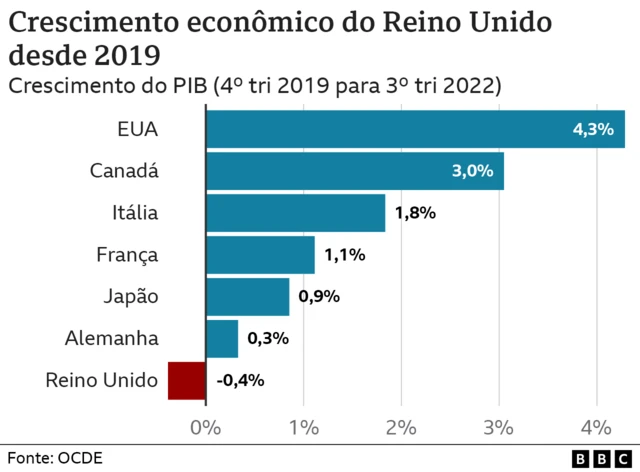

We have compiled our assumptions, judgements and analysis on this page. This paper examines the impact of the uks decision to leave the european union (brexit) in 2016. · since the announcement of the eu referendum we have been producing analysis and writing about the potential effects of brexit on the economy and public finances. Five years on from the day britain formally left. A sharp sell-off in stocks around the world followed. The institute for fiscal studies have said that the majority of forecasts of the impact of brexit on the uk economy indicated that the government would have less money to spend even if it no longer had to pay into the eu. · as per their figures, the uk’s gdp (gross domestic product) had fallen by as much as 8% from where it should be since 2016, with the impact ‘accumulating gradually’ as the years have gone by. Using almost a decade of data since the referendum, we combine simulations based on macro data with estimates derived from micro data collected through our decision maker panel survey. · economically , the country has faced trade disruption and labour shortages, while politically, it has reclaimed sovereignty at the cost of increased domestic turmoil and international complex diplomatic relations. · brexit was hugely divisive, both politically and socially, dominating political debate and with arguments about its impacts raging for years. · brexit wiped a record $3 trillion off global markets in two days, according to data compiled by standard & poors dow jones indices.